A Smaller Stick Is Still a Beating: Why Trump’s Tariffs Are No Brexit Dividend

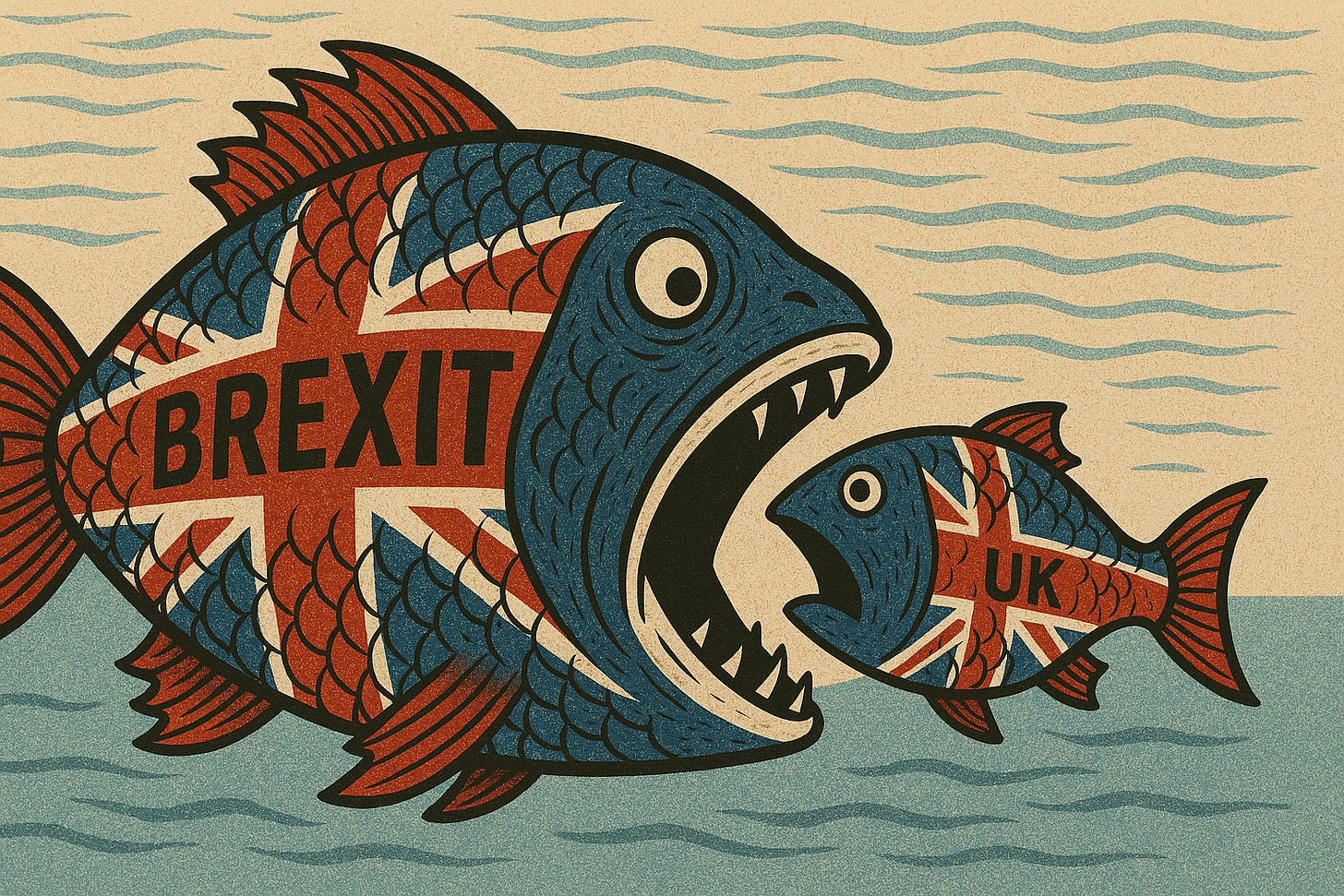

Brexit hasn’t delivered strength or sovereignty, just a poorer, more vulnerable Britain, now scrambling amid Trump’s trade war.

A False Dividend: Trump’s Tariffs Don’t Vindicate Brexit, They Expose It

There’s something almost poetic about watching Brexit’s cheerleaders scramble to spin a 10% US import tariff as a “Brexit win.” It’s like watching someone leap off a cliff, then proudly boast they only broke both ankles, not their spine.

Yet this is the narrative currently being peddled by a familiar cast of voices, from Nigel Farage to Jacob Rees-Mogg, bolstered by supportive headlines in The Telegraph and GB News. The argument goes like this: Donald Trump’s new tariff regime imposes a 20% levy on goods from the European Union but only 10% on British exports. This, they say, is a “Brexit dividend,” a reward for having left the EU’s orbit.

It is not. The claim is not only economically incoherent but borders on outright dishonesty. A 10% tariff is not a benefit, it is a penalty. That others are being penalised more heavily does not change the fact that Britain is now facing a trade barrier that did not exist before. To frame this as a triumph is to fundamentally misunderstand both the mechanics of international trade and the scale of the economic damage Brexit has already inflicted.

A 10% Tariff Is Still a Trade Barrier

Tariffs, by definition, make exports more expensive and less competitive in overseas markets. A 10% import duty on British goods in the United States will raise costs for American consumers, reduce demand for UK products, and place additional pressure on British businesses already operating in a challenging global environment. In sectors such as automotive, machinery and electronics, this could result in lost contracts, reduced investment and lower employment.

Some have suggested that the UK’s tariff being half that of the EU’s constitutes a competitive advantage. This is a misunderstanding of both context and consequence. The lower rate does not improve Britain’s trading position; it merely worsens it slightly less than that of others. It is a relative difference within a negative shift. We are not gaining ground. We are simply falling more slowly.

To interpret this as proof of Brexit’s success is to celebrate decline because it is marginally less dramatic than it might have been. It is not a dividend. It is damage control, and barely that.

Trump’s Tariff Math Has Nothing to Do With Brexit

The idea that Britain received preferential treatment because of its supposed post-Brexit independence is not supported by the evidence. The United States’ decision to impose differentiated tariffs appears to have been driven not by diplomatic favour, but by crude trade balance calculations. The US runs a trade surplus with the UK, and a significant deficit with the EU. Trump’s tariff scheme, such as it is, reflects that imbalance.

This is why countries like Brazil, India and South Korea have also been assigned the same 10% tariff. Are we to believe they too are being rewarded for their sovereign trade policy alignment with Washington? Of course not. The reality is that Britain was placed in a lower tariff category not because of Brexit, but in spite of it.

Even Andrew Griffith, the Conservative MP who initially described the tariff as a “Brexit dividend”, later admitted in Parliament that the UK had received no special treatment from the White House.

The Broader Economic Context: Brexit’s Ongoing Cost

To properly assess whether this moment represents any kind of gain, one must consider the broader economic context. The Office for Budget Responsibility estimates that Brexit will permanently reduce UK GDP by approximately 4 per cent. That figure dwarfs any temporary or superficial advantage derived from a lower import duty.

Moreover, the Centre for Economic Policy Research estimates that UK GDP is already between 2 and 3 per cent smaller than it would have been had Britain remained in the EU. Trade volumes are down by around 15 per cent, driven by higher friction, regulatory divergence and logistical costs. Customs paperwork alone adds around €10 billion annually to the cost of doing business with the EU. The House of Commons Library estimates a £37 billion annual loss to UK businesses due to reduced trade with the EU.

All of these costs are structural. They are ongoing. They are the direct consequence of leaving the single market and customs union. To seize upon a 10% tariff as evidence of success, while ignoring these far larger losses, is a masterclass in wilful economic blindness.

Business Reaction: Alarm, Not Celebration

The reaction from business leaders has been unambiguous. The Confederation of British Industry warned of “untold damage” to exporters. The British Chambers of Commerce have described the situation as a “lose-lose”. Manufacturing representatives, particularly those in Northern Ireland, have expressed concerns that retaliatory measures from the EU could place local firms at a further disadvantage.

This is not the language of triumph. It is the language of firms bracing for impact. The UK’s major exports to the US – including pharmaceuticals, industrial equipment and food products – are not somehow exempt from these economic pressures. They will be hit. And in some cases, such as automotive, they are already subject to additional 25% tariffs on specific categories of vehicles and parts.

Celebrating a marginally lower tariff amidst this landscape is like claiming victory in a fire because your neighbour’s house burned down faster than yours.

Sovereignty or Isolation?

What this episode also exposes is the diminished influence Britain now holds in global trade diplomacy. The EU, for all its challenges, retains significant leverage. It can coordinate retaliation, protect member states through collective bargaining, and assert its interests on the world stage. Britain, by contrast, is forced into bilateral firefighting – reacting to Trump’s trade war with limited tools and even fewer allies.

Already, reports suggest the UK is considering dropping its digital services tax to appease Washington and avoid escalation. That is not sovereignty in action. It is vulnerability. The government is not leveraging independence. It is scrambling for favour.

A Pyrrhic Narrative

There is no Brexit dividend in Trump’s tariffs. There is only a false narrative, constructed to distract from the economic damage Brexit has caused and continues to cause. A 10% tariff is not a reward. It is a penalty. And it is being touted as a win only because the alternative – a 20% tariff – is worse.

The problem with this logic is that it invites us to accept mediocrity as success. Worse, it encourages the belief that Britain can thrive on scraps and soundbites rather than substance. The economic data does not support that belief. The forecasts do not support it. Nor do the views of economists, business leaders or Britain’s own fiscal watchdogs.

Britain remains poorer, less productive and more isolated than it would have been had it remained inside the European Union. That is the real legacy of Brexit, and no tariff tweak can obscure it.